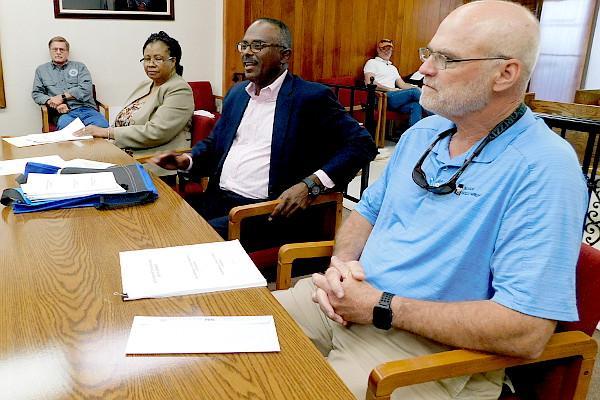

Photo by Sue Watson(From left) Four members of the Marshall County Housing Committee Task Force, Ken Jones, Juanita Dillard, Gary Anderson and Steve Gresham, report to supervisors. Not shown is Chuck Thomas.

Housing Task Force reports to board

Consultant Gary Anderson and members of the Housing Committee Task Force recently updated the Marshall County Board of Supervisors on the group’s work.

The committee was assigned to study causes contributing to the lack of construction of sticks and bricks homes as opposed to additional mobile home units.

The county wants to expand its tax base with standard built homes that will retain their value over time.

Anderson called the committee work “a labor of love.”

The committee focused on the issues at hand, custom-built, conventional housing and what factors may impact housing development. There were a number of factors studied in the assessment including the banking sector, builder and developer concerns, and the quality of education in the county that may impact people moving here.

“We focused on what has happened since the 2007 financial crisis,” Anderson said. “From 1990 to 2007, housing in the county grew, but in 2008 the financial crisis hit and impacted housing development.”

The insight of developers, bankers and municipal leaders was solicited so the committee could assess the status of housing and challenges the county will face going forward.

The committee also created a list of recommendations that could help chart a new course for the county.

Steve Gresham, committee member and president of the Bank of Holly Springs, said developers’ concerns will have to be addressed.

“We all need housing,” he said.

Supervisor Keith Taylor asked if any incentives for developers could be offered to help them develop more subdivisions.

“Where are people going to live who come here to work?” he asked.

“Developers want a more friendly environment,” Anderson said. “That includes a review of tax incentive programs which would require new legislation at the state level. You want to make it most appealing to those who are fixing to make a major investment in the county.”

Supervisor George Zinn III asked if persons who would like to get financing would benefit from education on budgeting. He also wondered why people would not purchase a conventional home as opposed to mobile homes, saying the cost for a moderate-size conventional house and a mobile home should run about the same.

Supervisor Ronnie Joe Bennett argued it is easy to buy a mobile home in the $80,000 to $90,000 range, which carries the financing with it.

“I’d rather take that and put it into a house,” he said. “Mobile homes depreciate so fast. How can they get financing for mobile homes so quickly? I do not understand how mobile home companies can finance this then reclaim the property when the person does not pay.”

Taylor added that mixing mobile homes in areas with conventional homes hurts property values in stick-built homes.

Anderson said he does think mobile homes affect property values.

“Mobile home manufacturers know if you make something appealing, no money down and high interest, and you can get them placed when there are no houses waiting to move into.”

He said it is a part of the culture that people who have not saved for a downpayment can get mobile home housing quickly.

Gresham said the only way to stop mobile homes from mixing in areas with stick-built homes “is to zone them out.”

“In the long run, zoning would help,” Taylor said.

Chancery clerk Chuck Thomas pointed out it takes eight or nine months to build a house but only about six weeks to get into a mobile home.

Supervisor Charles Terry asked for time to study the report and recommended supervisors do that and then come back “and see what we can do to keep it rolling.”